Discounted Payback Period Formula

Where A Last period with a negative discounted cumulative cash flow. PP refers to the payback period in Years I refers to the sum that you have invested.

Discounted Payback Period Formula With Calculator

In other words it allows us to discount the future cash inflows or outflows and calculate their present value.

. PP I C. Discounted payback is straight forward there no special software or system requires. This can be worked out in the following way.

The discounted payback period formula is the same as that simple payback period method explained in a different post apart from one thing. Lets look at the calculations. Read through for the definition and formula of the DPP 2 examples as well as a discounted.

Here is the formula for the discounted cash flow. Then you will need to calculate the discounted cash flows. This equation can be used to estimate the payback time for an apartment.

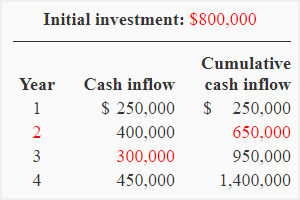

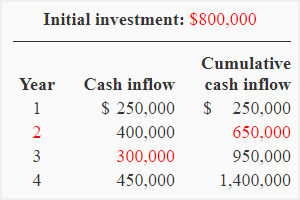

The simple payback period formula would be 5 years the initial investment divided by the cash flow each period. However the discounted payback period would look at each of those 1000 cash flows based on its present value. To start calculating the discounted payback period you would first consider the -5000 in the initial period.

Advantages of discounted cash flow. Discounted Payback Period Formula. The number of years that the project remains unprofitable to the company.

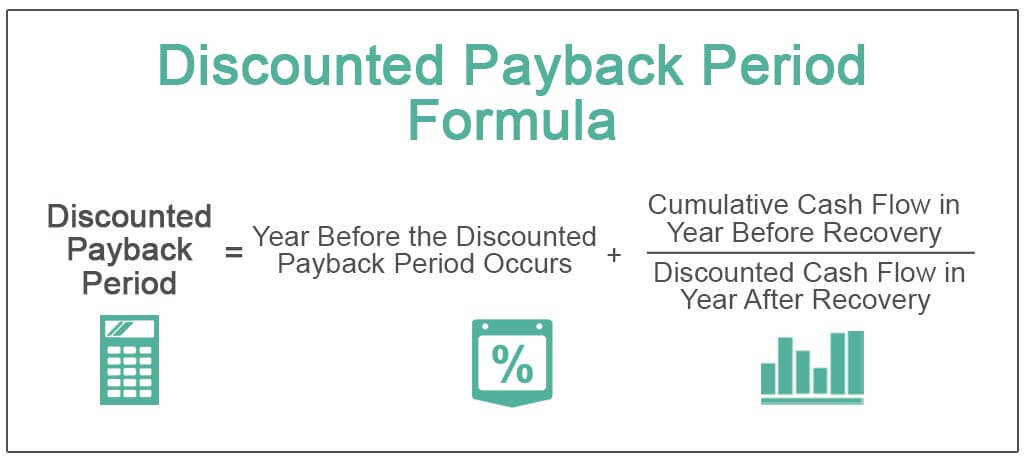

The cash produced in the period that the company begins to turn a profit on. In the calculation of simple payback period we could use an alternative formula for situations where all the cash inflows were. And C Discounted cash flow during the period after A.

The discounted payback period method accounts for the time value of money. We use two other figures in this calculation the PV or Present Value and the CF or Cash Flow. B Absolute value of discounted cumulative cash flow at the end of the period A.

Although it is not explicitly mentioned in the Project Management Body of Knowledge PMBOK it has practical relevance in many projects as an enhanced version of the payback period PBP. In order to calculate the discounted payback period you first need to calculate the discounted cash flow for each period of the investment. R discount rate.

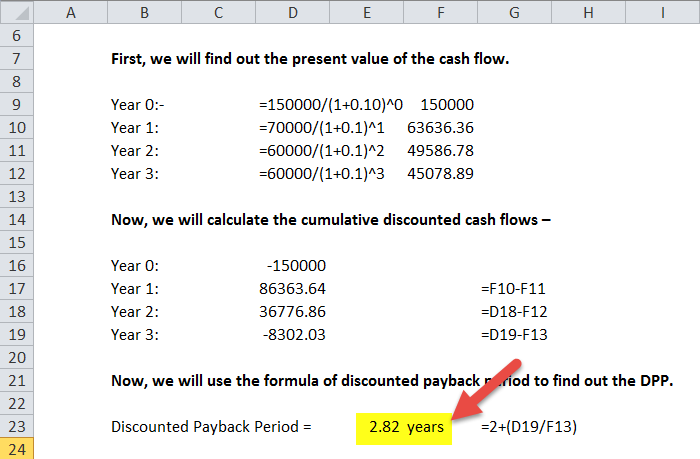

Discounted Payback Period Year before the discounted payback period occurs Cumulative cash flow in year before recovery Discounted cash flow in year after recovery 2 3677686 4507889 2. Discounted Payback period 5 year 3470039480 587 years. The method is easy to explain to others.

Assuming the rate is 10 the present value of the first cash flow would be 90909 which is 1000 divided 1r. N period of the individual cash flow. The discounted payback period DPP is a success measure of investments and projects.

It is the sum of the total investment and the annual cash flow. PP 100000 24000 417 years. The discounted payback period can be calculated by first discounting the cash flows with the cost of capital of 7.

To calculate the discounted payback period the future estimated cash flows of a project are taken and discounted to the present value using the discounted payback period formula. For the first year this would be 144231 1500 105. C actual cash flow.

We begin from the first year as the starting point. So when the first period has ended the project. You need to specify a set discount rate for the calculation.

This video shows an example of how to calculate the discounted payback period for an investmentThe discounted payback method is a decision rule that says a. C refers to the annual net cash flow - how much you earn. Then the first period would have a positive 1500 cash flow.

When compared to the initial outlay of capital for the investment this is a significant savings. The easiest way to accomplish this is to create a small table that lays. Divide the unrecovered amount by the cash flow amount in the recovery year ie.

Calculate the number of years before the break-even point ie. The discounted payback period is the time when the cash inflows break-even the total initial investment. The discounted cash flows are then added to calculate the cumulative discounted cash flows.

The Discounted Payback Period DPP Formula and a Sample Calculation.

Discounted Payback Method Definition Explanation Example Advantages Disadvantages Accounting For Management

Discounted Payback Period Meaning Formula How To Calculate

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Payback Period Formula And Calculator Excel Template

Discounted Payback Period Formula And Calculator Excel Template

Discounted Payback Period Meaning Formula How To Calculate

0 Response to "Discounted Payback Period Formula"

Post a Comment